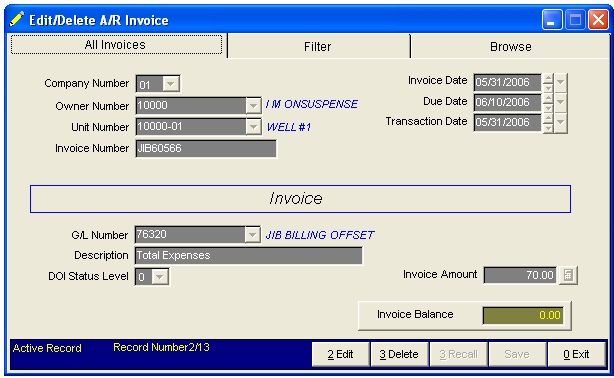

Edit/Delete A/R Invoice, Payment or JEs

Allows you to change entries to the Accounts Receivable invoice or payment application. You may change the invoice number, application date, transaction date, production date (if the general ledger number is 3xxxx), description, general ledger number, DOI status level, and invoice amount.

Select A/R - Invoices - Edit/Delete

This process works just like the one in A/P for Deleting A/P Invoices & Payments. You can refer to that section for more information on how this process works.

DELETE CAUTION

Will delete the applicable records from the following files.

Any Invoice or Application from the AR Detail file.

The associated records (Debits and Credits) from the Transaction file.

The associated records from the AR Register file.

Note: Records marked for deletion are not dropped until the file is PACKED. If the invoice or application has been previously marked for deletion, you can RECALL it (if the file has not been packed), by selecting “Recall’.

Deletions and Recalls are keyed by the invoice number and transaction date, therefore, if you made two payments to the same invoice on the same date (a rare occurrence) there is a possibility you could delete records for both payments by deleting just one of the payments.

Naturally, if the debit and credit for the invoice or application has already been moved from the Transaction file to the Year to Date Transaction file (during period closing), then the associated debit and credit is not deleted. In this case, you should enter a journal entry credit or debit in the Transaction programs to correct the general ledger ending balance and have a supporting document in the Year to Date Transaction file.

FILES UPDATED WHEN CHANGING ACCOUNTS RECEIVABLE INVOICE OR PAYMENT

Changing specific fields of an Accounts Receivable invoice will re-write changes to the following data files. You should be familiar with where values are stored in all files.

ARDET - The Accounts Receivable Detail file.

ARREG - Posting Register for Accounts Receivable.

ARINVREG - Information for printing of invoices.

TRAN - for a normal invoice: the specified general ledger number is credited for each line item and each unit, Accounts Receivable is debited for the total amount of the invoice for all line items. For a credit invoice: the specified general ledger number is debited for each line item and each unit. Accounts Receivable is credited for the total amount of the invoice for all line items.

CUST - The year to date total billed amount is stored.

BANK - Checks/Deposits posted to cash account will update the Bank file.

Suppose you change a type 0 (INV) application, and change the amount from $100 to $500 dollars. The amount will be re-written in the Accounts Receivable Detail file (ARDET.DBF), Accounts Receivable Register file (ARREG.DBF), Transactions file (TRAN.DBF), and increase the year to date billed amount in the Owner/Customer file (CUST.DBF).

If multiple posting was performed to the same invoice for different general ledger numbers, you may select 2 for next record. If you change the amount, the invoice balance will be updated for all the associated applications of this invoice.

NOTES ON FILTER FOR ACCOUNTS RECEIVABLE EDIT/DELETE FILTER

APPLICATION TYPE: Invoices can have 4 different types of applications. The applications are stored in the file as numbers (3=JEC, 5=PAY, 6=JED, 7=DSC). For example, if you wanted to pull up or print for Payments, use application type 5. You can also pull up invoices, federal withholding and state withholding transactions. (0=invoice, 8=FWH, 9=SWH)

COMPANY NUMBER: The company this invoice was assigned to.

OWNER/CUSTOMER NUMBER: The owner or customer this invoice was assigned to.

INVOICE NUMBER (Blank=Scroll or Number): You can enter a specific invoice number and only that invoice will be accessed. To Scroll through all invoices for an owner, leave the invoice number field blank. Scrolling will display the first invoice on file for the owner and ask if you want to make an application or skip to the next invoice.

NOTES ON FIELDS FOR ACCOUNTS RECEIVABLE EDIT/DELETE

COMPANY NUMBER: The company this entry was assigned to.

OWNER/CUSTOMER NUMBER: This is the number of the Owner/Customer that is used for each invoice and it cannot be changed. If an invoice was entered to the incorrect owner you must delete the invoice and pack data files. Enter the invoice to the correct owner number.

UNIT NUMBER: The unit number is processed from the Transaction file to locate the unit name from the Unit/Well file and the owner percentages from the DOI file. If no unit number is entered, the invoice is not billed to Investors. This number cannot be changed due to the effect it will have on the Operating Statements and netout procedures. If an invoice was entered to the wrong unit number you must delete the invoice, pack data files, and then enter the invoice to the correct unit number. It is recommended that you correct Operating Statements before deleting an Accounts Receivable invoice generated by the Operating Statement update.

INVOICE NUMBER: This is the original invoice number you entered for this owner or customer. If the invoice number is changed here it will be changed in the Transaction file, Accounts Receivable Register file, and Accounts Receivable Detail file. You may not change an invoice number to or from a credit. The last character of the invoice cannot be changed to "C".

INVOICE DATE: This is the Accounts Receivable invoice date when you entered the invoice in the Accounts Receivable programs. Changing the application date will rewrite the application date to all the corresponding data files. It will not affect the Transactions file because the application date is not stored there. You can use the calendar button to find a date for the invoice.

DUE DATE: The date this invoice is due. This is automatically figured by the system based on the billing terms specified in their Owner/Customer file.

TRANSACTION DATE: This is transaction date you entered for this invoice. The transaction date is used for Operating Statement billing if posted to general ledger numbers 3xxxx, 5xxxx or 71xxx-75xxx for a unit. Changing the transaction date will not affect payment date or the application date of the invoice. Changing the transaction date will rewrite the change to all the corresponding data files. You can use the calendar button to find a date for the invoice.

SALES TAX, FREIGHT CHARGE: These are part of the original invoice therefore if they were not entered in the original invoice you cannot add sales tax and freight in the change routine.

GENERAL LEDGER NUMBER: This is the general ledger number you entered when creating the invoice. Changing this number will change the corresponding invoice in all the data files.

DESCRIPTION: The description entered here will appear when the Accounts Receivable invoice is printed. This description field can be changed for a 0-type application only. For a PAY, JEC or JED, the system automatically writes the description.

DOI STATUS LEVEL: Status is stored in the Transaction file to locate the correct owner percentages in the DOI file for the transaction. Status of the transaction is used in Operating Statements, if the transaction was entered with a unit number and for general ledger numbers 3xxxx, 5xxxx and 71xxx-75xxx.

PRODUCTION DATE AND TYPE: The production date is the date that the oil and gas was produced, and the production type can either be "G" or "O". These are only asked when you post to a general ledger number of 3xxxx. When a change is made to either the production date or the production type the change is written to the Transaction file. Production date and type are used for the Well Analysis report.

PRODUCTION VOLUME: Production volume is the volume of oil or gas that was sold. If you change the volume, the invoice amount is recalculated. This production volume is printed on the Well Analysis report.

UNIT PRICE: This unit price is multiplied with the production volume to calculate the total amount.

INVOICE AMOUNT: This is the amount for each part of the invoice. If the invoice amount is changed, the invoice balance will be updated for all the parts associated with the invoice. If a payment amount is changed, the Bank file will be updated. Print an Accounts Receivable Posting Register, Inquiry Report, Transaction Report, and invoices if necessary to verify that changes were written to all the programs.

Note: The invoice must reside in the Accounts Receivable Detail file (ARDET.DBF), Accounts Receivable Register file (ARREG.DBF), and the Transaction file (TRAN.DBF) to make changes to an invoice.

Roughneck Help System 02/15/07 10:30 am Copyright © 2006, Roughneck Systems Inc.